Why the No Surprises Act

In December 2020, Congress passed the so-called “No Surprises Act” as part of H.R. 133, Omnibus Appropriations and Emergency Coronavirus Relief Act. The purpose of the No Surprises Act is to protect patients from unexpected medical bills that sometimes occur when receiving care from out-of-network providers and require the insurance payor and medical provider to resolve all payment disputes through negotiation and an independent resolution process.

A surprise medical bill typically consists of two components:

- The difference in the patient cost-sharing between out-of-network and in-network providers

- Balance billing, which is the difference between the provider’s full charge and the allowable charges

When Did the No Surprises Act Take Effect?

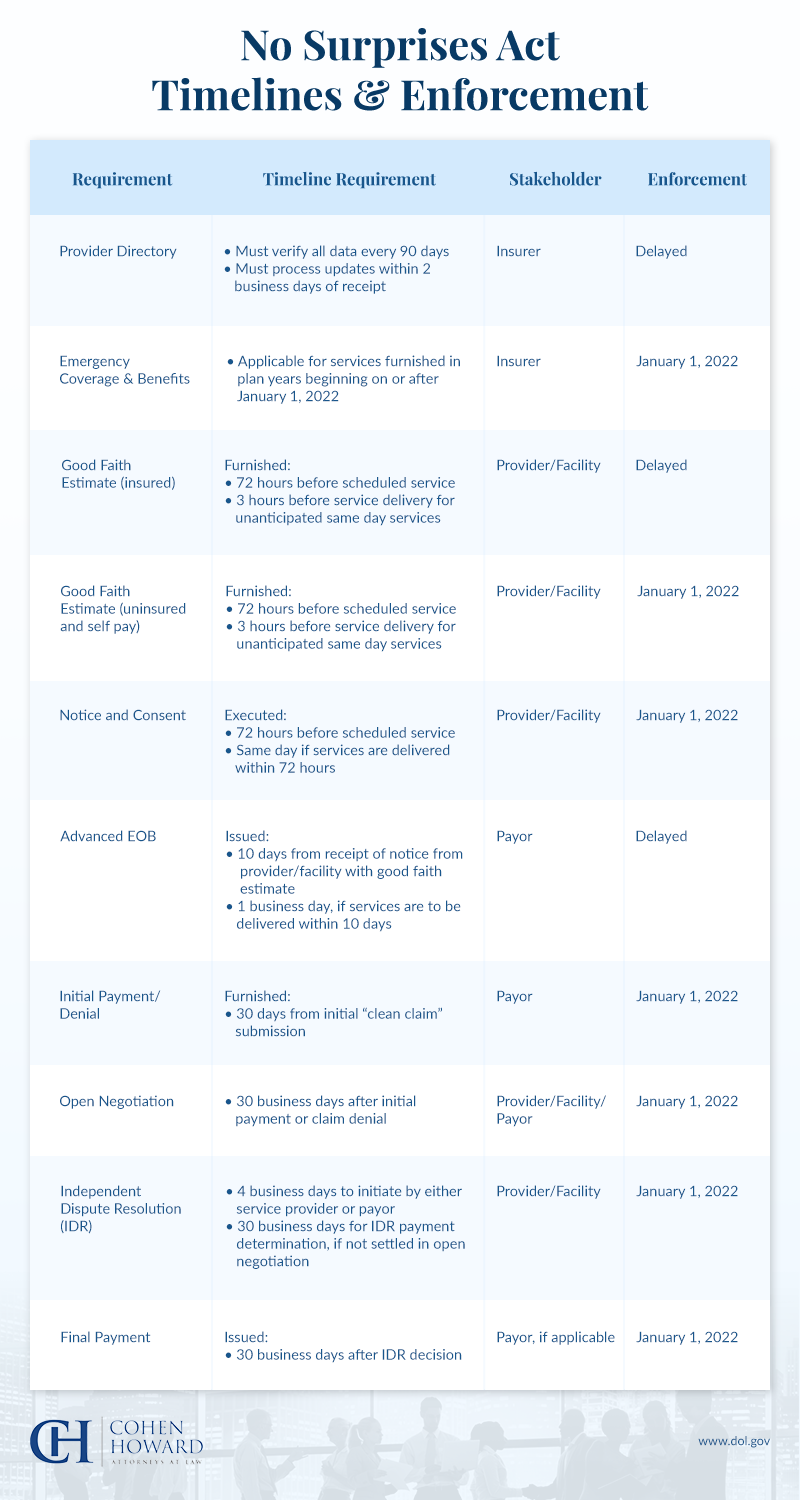

Most of the provisions listed in the No Surprises Act became effective on January 1, 2022, impacting virtually all plan types. The Departments of Health and Human Services (HHS), Labor, and Treasury are responsible for the No Surprises Act regulations and guidance for the implementation of many of its provisions. The Act will not preempt similar laws that exist in states that have existing payment dispute resolution processes, such as New Jersey and New York.

What Does the No Surprises Act Cover?

The No Surprises billing legislation of 2022 targets general areas, including:

1. Surprise Medical Billing for Emergency Services

Under the law, when patients receive emergency medical treatment from an out-of-network provider, they’ll only be responsible for the same deductibles and copayments as they would when getting in-network care under their insurance plans. The Act also extends to air ambulance services that have historically been a significant source of surprise billings.

2. Surprise Billing for Nonemergency Medical Services

The Act also protects patients from surprise medical bills when out-of-network providers administer treatment at an in-network facility. Patients will only be responsible for their in-network cost-sharing amounts, although exceptions will apply including cases in which the out-of-network provider meets certain notice and disclosure requirements, and the patient has provided requisite consent.

3. Resolution of Payment Disputes Between Insurance Companies and Providers

Finally, the Act stipulates that insurers and health care providers will have a 30-day open negotiation period to settle a payment dispute before either party can initiate the independent dispute resolution (IDR) if the out-of-network provider and the health plan are unable to agree on the payment amount. There is a four-day window, starting the day after the end of the open negotiation period to jointly select an IDR entity to submit the matter to a binding determination.

Are Self-Insured Plans Part of the No Surprises Act?

Under the Act, both fully insured and self-insured group health plans must hold their participants harmless from out-of-network surprise medical bills and any financial liability beyond the plans in-network cost-sharing requirements for the services covered under the No Surprises Act.

Implications of the No Surprises Act for States

In some cases, “Specified State Law” will be applied instead of the No Surprises Act. The Centers for Medicare & Medicaid Services’ (CMS) Center for Consumer Information and Insurance Oversight (CCIIO) has issued letters that address the state-by-state applicability of the NSA rules.

These letters explain how the federal IDR process is applied in each state and in what situations. Check out CMS’ letter for your state for the most accurate and up-to-date enforcement information.

Contact Us to Learn More

If you’re a health care provider, you may have concerns about how the No Surprises Act will affect your ability to collect payments when delivering out-of-network care. With our specialized legal expertise in this area, the law firm of Cohen Howard can help you prepare for what lies ahead. Contact us to learn more.