The No Surprises Act (NSA), a federal law that prohibits healthcare providers from balance billing patients for certain out-of-network (OON) services, went into effect on January 1, 2022. A key provision of the Act includes an arbitration process for resolving payment disputes between health insurers and providers, referred to as the Independent Dispute Resolution (IDR) process.

What Is IDR?

The IDR process provides a framework for providers and payors to resolve payment disputes for claims subject to the NSA. The IDR process is a “baseball-style” arbitration such that the arbiter will ultimately choose one of the final reimbursement offers submitted by either the provider or the payor with the arbiter’s decision deemed final and binding, except for limited circumstances.

What Is the IDR Process and Timeline?

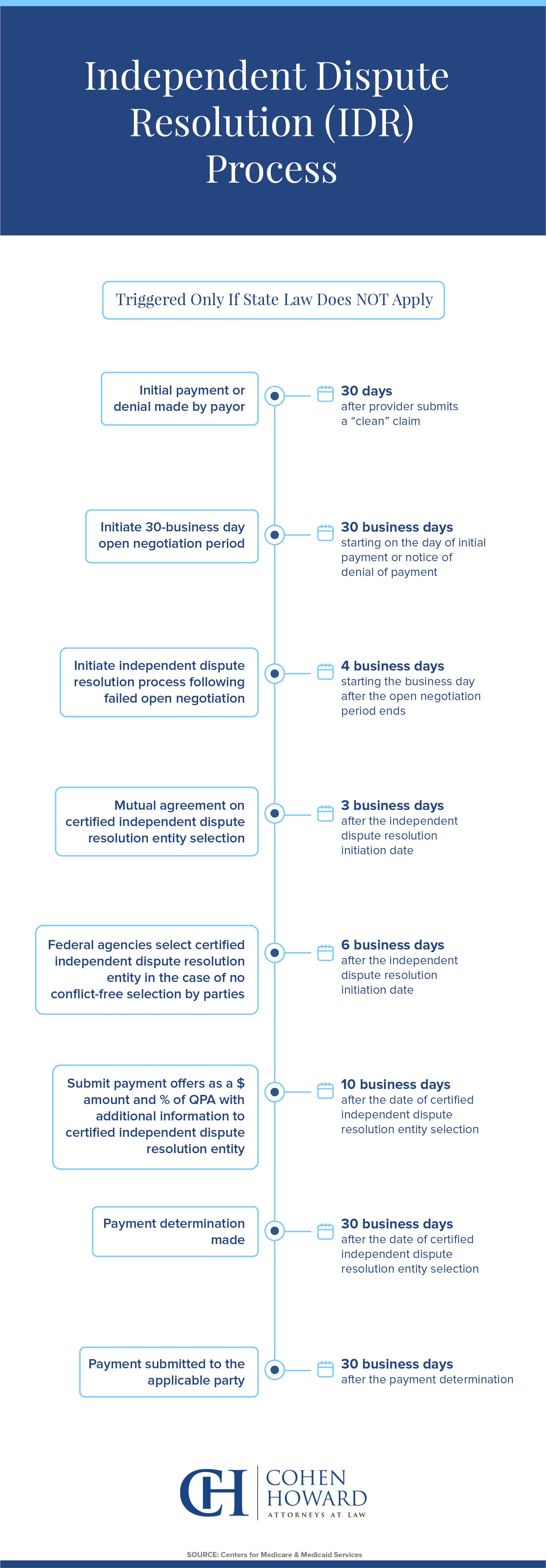

When a provider receives either an initial payment it considers inadequate or notification a claim is denied within 30 days of submitting the claim to the payor, the provider may initiate a 30-business day open negotiation period to attempt to resolve the issue. If the parties cannot reach an agreement during this window, either party has four business days from the end of the open negotiation period to request arbitration and must notify the other party in the dispute and the Department of Health and Human Services (HHS) that the IDR process is being initiated.

Either party may initiate the IDR with the initiating party selecting a certified IDR entity for arbitration. Within 3 days from the initiation of the IDR, there must be a mutual agreement on the selected IDR entity. In the event the parties are unable to agree on the IDR entity, the Department of HHS will select the IDR entity within 6 days from the IDR being initiated. The parties then have 10 business days to submit their final offers and supporting documentation to the third-party arbiter, who in turn has 30 business days to review the information and render a decision. The arbiter will choose between the final offers submitted by the payor and the provider.

According to the NSA Interim Final Rules, Part II, certified IDR entities (arbiters) must begin with the presumption that a plan’s median in-network rate for a service, also known as the qualifying payment amount (QPA), is the appropriate payment and must select the offer closest to the QPA.

Providers that submit offers to the IDR entity that are greater than the QPA will be able to submit additional “credible information” to the arbitrator to show that the QPA is not a fair out-of-network reimbursement. The arbiter may not consider the provider’s billed charges, usual and customary charges (UCR), or Medicare/Medicaid rates when deciding the final offer. Following the IDR determination the parties have 30 business days to make payments and the party with the offer that was not selected pays the arbitration fees. Fees are anticipated to range from $200 to $500 for a single claim determination, with each side also required to pay an administration fee of $50 for 2022.

Update:

The Texas Medical Association filed a lawsuit (TMA I), October 28, 2021 challenging the QPA presumption and the Federal District Court of Texas ruled in favor of the plaintiffs ordering the government to vacate this provision of the rules.

Contact Cohen Howard for Help Navigating the IDR Process

Cohen Howard has nearly a decade of expertise in maximizing revenue for payment disputes with payors for OON services rendered and guiding medical practices on documentation required for patients and payors to achieve success. We utilize a process to discern on a claim-by-claim basis the best pathway for a claim taking into account various factors, including the type of plan and plan document, Federal and State laws, and past practices of payors and employers.

Cohen Howard maintains a robust database with critical historical payment information to use for resolution of claim payments. Having dealt with the deny, delay, and deflect tactics of payors for years, we understand the importance of staying current on all legislative and regulatory actions that impact provider reimbursements. We remain committed to preparing our clients to comply with any further regulatory changes impacting out-of-network provider community.

Please call us at 732-747-5202 or contact us online to learn more. We’re here to help.