True Market Value® is pricing tool developed by the car industry (Edmunds) to help consumers navigate the complicated process of negotiating a fair price for a new or used car. This concept can be adapted by out-of-network providers to calculate the true maximum value of a claim. By setting clear expectations with your staff, you will be utilizing your limited resources in the most efficient and smartest way to increase your reimbursements.

Let me provide you with an example.

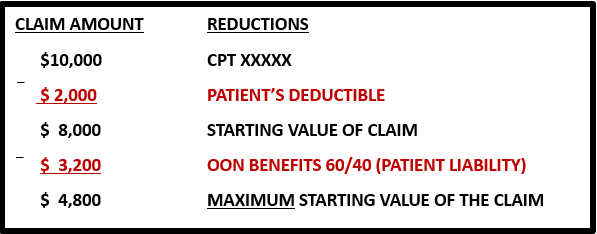

Assume a claim has a total of $10,000 in billed charges and the patient has a deductible of $2,000 that has not been met. The starting value of the claim is the difference between these two numbers or $8,000, which represents the starting point as the most a provider can attain at face value from the payor.

Taking it one step further, assume the patient’s out-of-network benefits specifies the coinsurance is 60/40% (provider/patient responsibility respectively), the maximum reimbursement that will be considered by the insurance company is really $4,800, less than half of the original billed charge of $10,000. In the event, multiple procedure reductions (MPRs) apply, the total amount recoverable for the claim would be reduced even further.

In the example above, the maximum amount the provider is entitled to receiving is $4,800. Assume the insurance company’s initial payment is $3,000, leaving a differential of $1,800. As business owners, providers need to determine the cost and benefit of dedicating resources to chase the balance of $1,800.

It is a given that providers are continuously denied payment or under-reimbursed for services rendered. Understanding how to determine the True Value of a Claim can be a powerful tool to help providers maximize claims reimbursements. In the end, it is a business decision and requires providers to develop strategies and benchmarks for handling claims, mainly what will be tolerated, to allocate resources accordingly.

Of course, State laws may impact the above calculation. Many States have now adopted Surprise Bill laws that prohibit balance billing of patients for care related to emergency services and inadvertent services. These laws require the member’s liability to be limited to in-network cost sharing obligations only. Further, in late 2020, Congress adopted the No Surprises Act which takes effect on January 2022.

The No Surprises Act will regulate both fully insured and self insured plan for emergency services and when inadvertent services, expanding the scope of protections for consumers beyond State regulated fully insured plans. The No Surprises Act will also limit patient liability to in network cost sharing obligations only where the medical services provided, emergency and inadvertent, are covered under the No Surprises Act.